Spain Approves Draft Bill for Compulsory B2B E-Invoicing

+++ Update January 17, 2024: Spain’s Mandatory B2B E-Invoicing — Navigating the Evolving Landscape

Spain’s journey to implementing mandatory B2B e-invoicing by 2025 is full of twists and turns, marked by political uncertainties, technical challenges and evolving regulations. Here’s a comprehensive update based on recent developments from four key contributors:

1. Policy and regulatory landscape

Recent political developments have created uncertainty around Spain’s ambitious plan for mandatory business-to-business ‘B2B’ e-invoicing. The original target of a spring 2025 launch, contingent on the formation of a coalition government by November 2023, is now in doubt. The inconclusive national election in July 2023 has temporarily halted bipartisan efforts, potentially delaying the launch until October 2025.

On the other hand, and not to be confused, the certification requirements for e-invoicing software ‘SIF / VERI*FACTU’ will come into force on July 1, 2025.

In addition, the EU’s ViDA digital reporting requirements ‘DRR,’ originally scheduled for 2028, will be delayed until at least 2030, prompting Spain to adjust its plans accordingly. The European Union’s ViDA digital reporting requirements, which affect Spain, are also expected to influence the final technical specifications and launch dates.

2. Phased approach and technical challenges

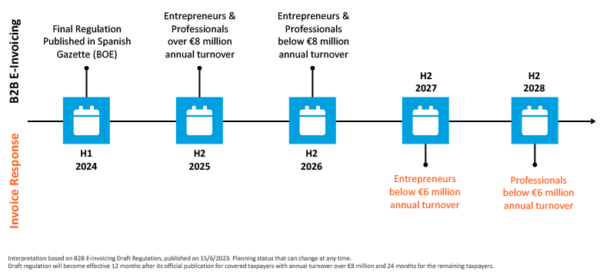

For the B2B e-invoicing mandate, Spain is considering a two-phase implementation, starting with larger taxpayers with a turnover of more than €8 million, followed by all other taxpayers. Technical challenges and delays in the legislative process suggest a summer 2025 launch at the earliest.

Invoice responses are intended to come into force even later and based on different thresholds.

3. Technical regulations and implementation details

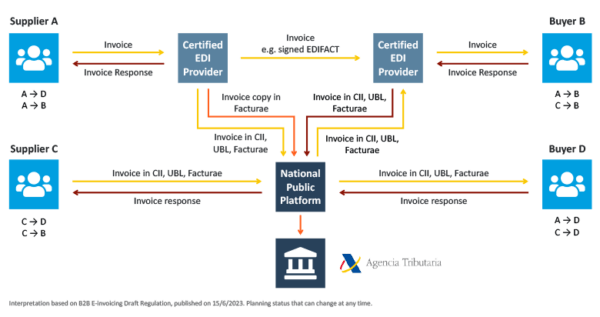

The Royal Decree published in June 2023 outlines the technical regulations for B2B e-invoicing in Spain. The law designates electronic invoicing as the exclusive method for transactions between businesses and self-employed individuals. Mandatory e-invoicing applies to B2B transactions, with exemptions for certain circumstances. Implementation will follow a phased approach, with the Royal Decree becoming enforceable 12 months after its publication. The system includes private e-invoicing platforms, a public e-invoicing solution and specific formats such as CII, UBL, EDIFACT and Facturae. The Facturae XML format is used in Spain for B2G e-invoicing through e-invoicing Platform FACe, which became mandatory in 2015.

4. Mission and objectives of the Ministry

The Ministry of Economy and Digital Transformation’s draft Royal Decree mandates electronic invoicing for all B2B transactions in Spain. The objectives include reducing administrative burdens, optimizing financial management, ensuring timely payments to suppliers and promoting efficient information exchange. Key highlights include the obligation for VAT-registered businesses and self-employed individuals to issue, send and receive electronic invoices.

The e-invoicing system consists of certified private invoicing platforms / operators and a public platform, with mandatory statuses to be maintained by invoice recipients as ‘Invoice Responses’. The e-invoicing system can be categorized as a decentralized Continuous Transaction Control (CTC) model – similar to the French B2B e-invoicing Y-model.

In conclusion, Spain’s journey towards mandatory B2B e-invoicing is dynamic, influenced by political, regulatory and technical factors. Stakeholders should keep up-to-date and be prepared for potential shifts in timelines and requirements.

Notice

As mentioned in a previous blog post below, Spain had published a regulation on the software to be used to generate invoices, the content of invoices and how to keep electronic records for tax audits. The related Royal Decree 1007/2023, dated December 5, 2023, approving the SIF / VERI*FACTU regulations, was officially published in the BOE on December 6, 2023.

Important: Do not to confuse the two streams of anti-VAT fraud instruments,

1) the SIF / VERI*FACTU certified billing software regulations and

2) the planned B2B e-invoicing mandate.

Even though both concern electronic invoicing, the SIF was designed to become a kind of “SII for SMEs and self-employed.” The intention to increase the VAT information reported to the AEAT by SMEs and the self-employed is in line with the SII VAT e-reporting to the AEAT, which remains unchanged. Consequently, those taxpayers who are obliged to use the SII or who voluntarily use the SII will be excluded from the SIF obligations.

+++

+++ Update June 26, 2023: New information on upcoming B2B mandate

The electronic invoice requirements for B2B transactions, as established in Law 18/2022 or “Crea y Crece,” have evolved. In the Spanish system, certified service providers are required to support electronic invoices in Facturae, CII, UBL and EDIFACT formats. A digital signature is required when service providers are exchanging invoices.

Service providers must also send a copy of the electronic invoice in Facturae format to the Spanish public platform. The recipient must inform the issuer of the status of the invoice, the date and commercial acceptance or rejection, as well as full payment of the invoice. The chosen CTC model is similar to a decentralized CTC exchange model.

Deadlines for issuing electronic invoices:

- Large businesses must start issuing electronic invoices 12 months after the publication of this Royal Decree.

- The remaining taxpayers are to issue electronic invoices 24 months after the publication.

Obligation to send the mandatory invoice responses applies to:

- entrepreneurs with an annual turnover of less than EUR 6 million, 36 months after the publication of the law.

- professionals with an annual turnover of less than EUR 6 million, 48 months after the publication of the law.

- large taxpayers that must comply with the SII accounting system (with an annual turnover of more than EUR 6 million), currently not issuing invoices.

Feedback on the draft regulations can be submitted until July 10, 2023. The draft regulation is available at the following link: ECO_Pol_AP_20230619_RD_factura_electronica.pdf (mineco.gob.es)

+++

+++ Update September 26, 2022: Spain: Legislation from 15 September 2022 “Crea y Crece” finalizes B2B e-invoicing obligation

While passing the law on the foundation and growth of companies “Crea y Crece”on 15 September 2022, Spain’s Congress of Deputies also gave final approval to the introduction of the B2B e-invoicing mandate.

After in-depth discussion, parliamentary cooperation with the autonomous regions and economic entities, the law received – with some adjustments – strong support in the Chamber of Deputies. The law is ready for publication in the government gazette and subsequent entry into force. With publication of “Crea y Crece” in the government gazette “Boletín Oficial del Estado” (BOE), expected in the coming days, the usual deadlines will take effect:

- Twelve months for companies and self-employed individuals with an annual turnover greater than eight million euros

- Thirty-six months for the remaining companies and self-employed individuals

Find more information on the adoption of the law on the creation and growth of companies “Crea y Crece” on the official website of the Spanish government.

+++

Spain has mandated e-invoicing for the B2G sector since 2015. Now, the Spanish government has approved a preliminary draft bill stipulating e-invoices for B2B transactions. This will make B2B e-invoicing mandatory in the domestic market for business relationships between companies and freelancers. Specifically, this draft law defines how invoices should be created, what they must contain, and the schedule for implementing these new requirements. By extending the obligation to issue e-invoices from the B2G to the B2B sector, the Spanish government hopes to boost the current potential to digitalise, simplify and save money in invoicing. Our e-invoicing expert Gerrit Onken has put together what you need to know.

Up until now, Spain has only mandated e-invoicing for B2G business relationships. Spain is now planning to extend this obligation to create and send electronic invoices to the B2B sector. This follows a similar pattern to both Italy’s e-invoicing mandate and the planned mandate in France, which both introduced e-invoicing to the B2G sector before extending it to B2B transactions.

Spain has published various draft laws which cover the following:

- Stipulations on the software to be used to generate invoices, invoice content and how to keep electronic records for tax audits

- Making e-invoicing mandatory for B2B transactions for both companies and contractors

Read on to discover what these changes mean for you.

New stipulations on invoicing software, invoice content and electronic records for tax audits

In a draft law of 21st February 2022, Spain’s financial ministry covers the following:

- What type of invoicing software to use

- Invoices to contain an alphanumeric ID code and a QR code

- Creating invoice records for tax audits, which can be electronically transmitted to AEAT as required

- Ensuring that AEAT has immediate access to invoice records for tax audits.

The draft law states that, as of 01.01.2024, companies need to use computer software that meets certain requirements to issue invoices. These “VERI*FACTU systems” (verifiable invoicing systems) are certified computer systems capable of automatically transmitting invoices to the tax authorities correctly, completely, promptly and securely. If an invoice is created on one of these certified computer systems, the origin and integrity of the content of the invoice is automatically deemed to be authentic. It therefore doesn’t need an electronic signature.

The e-invoices also need to contain an alphanumeric ID code and a QR code which both meet certain criteria from the ministry of finance. If they wish, invoice recipients can contact the tax authority with the alphanumeric identification code and QR code from their invoice to crosscheck the invoice they have received and the copy submitted to the authorities. Portugal has been using this system very successfully for years and invoice recipients are granted tax rebates for cross-checking. This makes is an effective monitoring tool.

Why not take a look at our article on Ticket BAI, a similar system used by the Basque provinces?

E-invoicing mandatory for B2B transactions between companies and freelancers

At the end of 2021, the Spanish government published a draft law on “The Creation and Growth of Companies “, which makes B2B electronic invoicing mandatory in the domestic market for business transactions between companies and freelancers. On 24th February 2022, the Spanish parliament approved the draft law of 17.12.2021. At time of writing (March 2022), the law has not yet been published in the Official Gazette “Boletín Oficial del Estado” (BOE).

Once the law is published in the BOE, the following schedule will apply:

- Companies and self-employed persons with an annual turnover of more than eight million euros are required to issue e-invoices 12 months after publication in the BOE.

- All remaining companies and freelancers will be required to start e-invoicing within three years of publication in the BOE.

The main objective of the legislation is to encourage business to help drive growth in Spain. Further goals behind promoting e-invoicing in business transactions involving companies and self-employed persons are to:

- Drive digital transformation in business relationships

- Reduce transaction costs

- Increase transparency

- Combat arrears

The Spanish B2B e-invoicing mandate

All companies and sole contractors are required to issue and send electronic invoices in their business transactions with other companies and freelancers. These e-invoices need to meet the criteria set out by the Spanish ministry of finance, including the new stipulations on content and software.

Companies and freelancers must make the necessary programmes available to their customers so that they can read, copy, download and print their electronic invoices free of charge. They may not charge for these activities, nor may they expect their customers to acquire their own applications.

Invoice recipients must be able to electronically view and download invoices free of charge for at least four years. This applies even if a contract between parties has ended or if the invoice recipient no longer wishes to receive electronic invoices after a certain date.

Failure to comply with these obligations constitutes an administrative offence which may be sanctioned by a warning or a fine of up to 10,000 euros. The sanctions are governed by Art. 19 of Law 6/2020 of 11th November 2020 regulating certain aspects of electronic fiduciary services. The fines are staggered, with the amount a company is ultimately fined based on various criteria.

Spain has had an e-invoicing mandate for its B2G sector since 2015, when it was one of the first countries in Europe use Facturae XML and the FACe platform to implement B2G e-invoicing and make it legally mandatory for suppliers. Conversely, introducing e-invoicing with structured electronic invoices for its B2B sector on a voluntary basis has not progressed well. This is where the approved draft law will soon do some “convincing” in order to increase the potential identified in digitalisation, simplification and cost reduction. Exchanging and processing digital invoices is associated with savings of several euros per invoice. Indeed, the savings are even higher for the invoice recipient than for the invoicing party, particularly once processing the electronic invoices has been automated.

How can SEEBURGER help?

SEEBURGER Global E-Invoicing Services already provide B2G e-invoicing services via the FACe platform, VAT reporting to the Spanish tax authorities’ SII system and EDI supported e-invoicing. SEEBURGER’s particular expertise is in integrating systems and getting data flowing to where it is needed. We can integrate your ERP system with your e-invoicing systems, including a seamless integration of SAP S/4HANA via the SAP API Business Hub. We are also an established provider of cloud services and have many years’ experience in understanding and implementing the systems you need to meet the demands of various EU countries and further afield.

Thank you for your message

We appreciate your interest in SEEBURGER

Get in contact with us:

Please enter details about your project in the message section so we can direct your inquiry to the right consultant.

Written by: Gerrit Onken

Gerrit Onken has been at SEEBURGER since 2010 as a product manager for software applications and for electronic data exchange services for the business sector. He focuses on solutions for SAP, electronic invoicing (e-invoicing) and innovations for digitalizing business and technical processes for globally-active customers. Originally a banker, Gerrit Onken went on to graduate in business administration, majoring in industrial management and business informatics. After working in the financial sector, he worked as a manager and project manager from 2004 to 2010 for one of the top five corporate consultancies, working with international BPOs in the banking and automotive industries.