Electronic VAT returns will become obligatory in the United Kingdom as of 1st of April, 2019 – comply with the Making Tax Digital (MTD) requirements to avoid penalties

What is MTD?

MTD is a UK government initiative to make tax administration easier and more effective. On the one hand VAT registered businesses must keep their records digitally. On the other hand they have to submit their VAT return information quarterly to the UK tax authority HMRC (Her Majesty’s Revenue and Customs) via MTD compatible software. According to HMRC, approximately one million businesses are affected by MTD – the majority as of 1st of April, 2019.

Who is obliged to follow MTD and when to start?

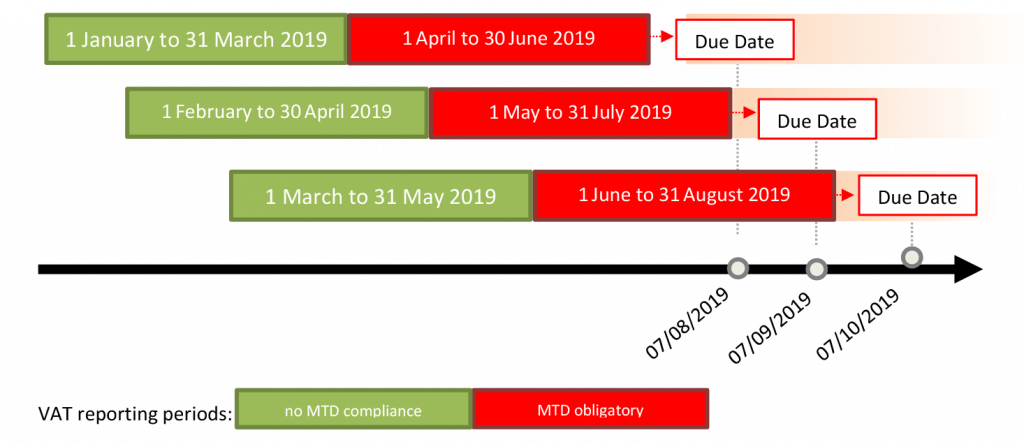

Every UK VAT registered taxpayer (with an annual turnover of 85,000 GBP or more) has to comply with MTD by 1st of April 2019. However, the individual MTD start time may differ from this date depending on the business VAT periods. For example, if the VAT return covers the period from 1st of January to 31st of March 2019, MTD must be complied with as of the 1st of April 2019.

However, there is a deferral date of the 1st of October 2019 for complex businesses, i.e. trusts, ‘non-profit’ organisations and public corporations.

How does the submission of VAT returns work?

The content of the VAT return (nine boxes of VAT information) stays the same as used on paper for the past years. However, the mechanism for submitting the VAT return is changing from paper to on-line. The relevant tax information must be transmitted from business compatible software using HMRC’s API (Application Programming Interface). However, there must be a so called ‘digital link’. This means that transferring data manually within or between different parts of software programs is not permissible. NB: during the first year of MTD obligations there will be a grace period to afford companies more time to implement a ‘digital link’. Therefore, VAT information can be ‘copy & pasted’ between software programs until 31st of March 2020.

What happens if you fail to comply with the MTD obligation?

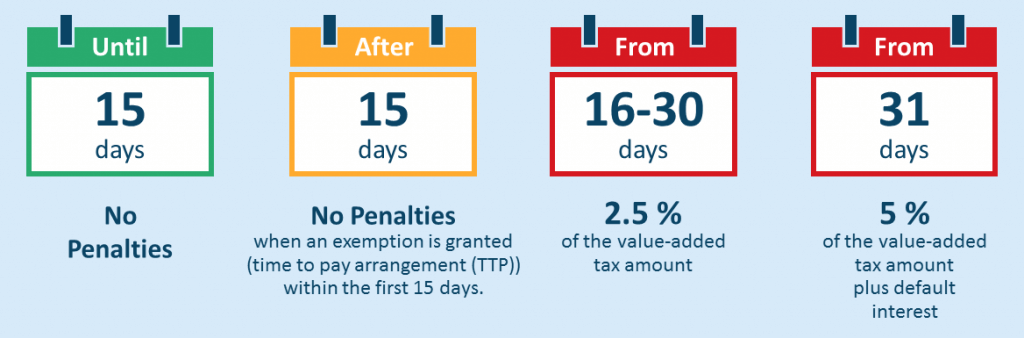

Companies that do not maintain digital records will be penalised from April 2019. The situation is different with penalties for late payments and submissions, as these will not be effective until April 2020. Depending on the duration of the late payment, the penalties will be as follows:

Additionally, a penalty point system will become effective. Every time a company fails to submit their MTD report in time, a penalty point will be accumulated. Once a certain threshold of penalty points is reached, a fine has to be paid. For quarterly MTD reports the threshold will be four points.

Let SEEBURGER help you simplify the complex MTD process quickly to avoid incurring any penalties

The MTD process is complex and time-critical. In order to make your system implementation efficient and minimise risks, it’s highly recommended to collaborate with a partner who understands the requirements not only of MTD in the UK, but also of tax authorities in other countries. Such an experienced partner can skilfully and professionally support your system introduction and accommodate your growing volume of international reporting and e-invoicing obligations. This ensures uniformity and standardisation. For cost efficiency reasons, it’s also recommended to start with a ready-to-use cloud-based service.

Reporting requirements such as those in the UK can be technically complex and cause high initial costs in your own business. These difficulties can be avoided with an out-of-the-box, pre-configured cloud-based service to which the invoicing information is reported via a clearly defined interface format.

The SEEBURGER VAT reporting Cloud Service for UK and many other countries provides a secure, reliable, and highly-performant service which allows complete cost transparency and an overview of VAT status. We transfer the data via the HMRC API and also generate the JSON records as specified by HMRC. This Cloud Service is designed to work with any ERP system.

Vielen Dank für Ihre Nachricht

Wir freuen uns über Ihr Interesse an SEEBURGER

Haben Sie Fragen oder Anmerkungen?

Wir freuen uns hier über Ihre Nachricht.

Ein Beitrag von: Gerrit Onken

Gerrit Onken ist seit 2010 bei SEEBURGER als Produktmanager für Softwareanwendungen und für den Bereich Elektronischer Datenaustausch (EDI) tätig. Seine Schwerpunkte sind Lösungen für SAP, elektronische Rechnungsstellung (E-Invoicing) und die Digitalisierung von geschäftlichen und technischen Prozessen für global agierende Kunden. Ursprünglich gelernter Bankkaufmann, absolvierte Gerrit Onken ein Studium der Betriebswirtschaftslehre mit den Schwerpunkten Industriemanagement und Wirtschaftsinformatik. Nach seiner Tätigkeit in der Finanzbranche arbeitete er von 2004 bis 2010 als Manager und Projektleiter bei einer der fünf größten Unternehmensberatungen mit internationalen BPOs in der Banken- und Automobilbranche.