E-Invoicing in Austria via PEPPOL

PEPPOL is the technological basis for e-procurement in the EU – and is also a good (but not the only) option for e-invoicing in Austria.

PEPPOL is the technological basis for e-procurement in the EU – and is also a good (but not the only) option for e-invoicing in Austria.

PEPPOL-UBL and ebInterface are recognized as formats for invoices to the Austrian federal government.

In many EU countries PEPPOL is developing and spreading more and more. Please also read our blog with an introduction to PEPPOL.

Where in Austria is e-invoicing mandatory and where is it already possible?

Electronic invoicing Business-to-Government (B2G) by the federal government has been mandatory since 1st of January 2014. All (Austrian-based) suppliers of Austrian federal institutions are obliged to transfer invoices in electronic form in accordance with the Austrian ICT Consolidation Act (IKTKonG).

The institutions of the federal government or the federal government are in general:

- All ministries and their subordinated administrative offices

- The parliament

- The office of the federal president

- The higher administrative court

- The constitutional court

- The Austrian ombudsman board

- The court of audit

Many other institutions in the public sector (e.g. federal states, municipalities and state-owned companies) are able to receive e-invoices – even though it is not yet mandatory for suppliers with these other institutions.

The automation of invoicing through e-invoicing is worthwhile in comparison to manual processes with paper if it covers as many invoice recipients as possible.

In which formats can B2G invoices be transmitted in Austria?

B2G invoices in Austria can be issued in the following formats:

- ebInterface is the national XML invoice standard for

- PEPPOL-UBL is a common international standard and uses a subset of the UBL 2.0 specification. UBL is an open standard maintained by OASIS and is also used in other countries.

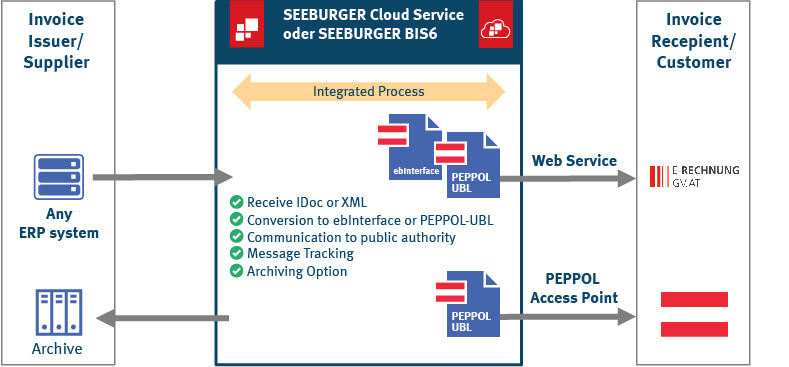

Which transmission routes for B2G invoices are possible in Austria?

In Austria, B2G invoices can be transferred by the following means:

- Manual upload via E-RECHNUNG.GV.AT. This is a good option in case invoices are rarely sent to the public sector.

- Use of the Internet platform E-RECHNUNG.GV.AT for automatic exchange of data

- via Webservice:

E-RECHNUNG.GV.AT supports the formats ebInterface and PEPPOL-UBL . - via the PEPPOL transport infrastructure

E-RECHNUNG.GV.AT only supports the PEPPOL-UBL A centralized public PEPPOL Service Metadata Publisher (SMP) for Austria is used for this purpose. In this SMP there are currently 5,000 users activated as PEPPOL receivers.

- via Webservice:

Summary

The use of the PEPPOL transport infrastructure for sending electronic invoices based on the PEPPOL-UBL format is an accepted method of electronic invoicing in Austria and a good alternative to the use of web services and the ebInterface format.

Larger companies with different e-invoicing requirements should consider solution providers that provide them with the necessary access to E-RECHNUNG.GV.AT (for sending to B2G authorities) via a PEPPOL access point and also have the competence to support the different e-invoicing data formats all over Europe.

Such a provider allows the e-invoicing process to be fully automated without the need for just a single direct connection to E-RECHNUNG.GV.AT. The connection to the provider can be reused to facilitate e-invoicing in other countries.

SEEBURGER Cloud Services makes it quick and easy to send EU-compliant invoices to authorities and other partners in Austria.

Despite increasing standardization, e-invoicing is and remains complex. It is therefore important to select a partner for your e-invoicing projects who is fully familiar with different scenarios. Regardless if it should be the PEPPOL-UBL or ebInterface format or whatever other e-invoicing formats should be used and regardless the ERP system the invoice data comes from.

SEEBURGER offers you a plug-and-play cloud service for Austria, to which you can simply transfer the invoice data. Our E-Invoicing services are independent of the ERP system and include the legally required archiving for Austria.

Thank you for your message

We appreciate your interest in SEEBURGER

Get in contact with us:

Please enter details about your project in the message section so we can direct your inquiry to the right consultant.

Written by: Andreas Killinger

Andreas Killinger joined SEEBURGER in 2014 and is a product manager, responsible for EDI services and software applications. He specialises in SAP solutions, as well as electronic invoicing (e-invoicing) for globally active customers. Following an apprenticeship as an industrial mechanic and a degree in law and administration, he had various roles in the public sector. He then worked for IBM as an SAP Senior Consultant and SAP Project Manager in international SAP projects from 1999 to 2013.